Quarterly Financial Report: Quarter ended December 31, 2023

Table of contents

1. Introduction

This Quarterly Financial Report should be read in conjunction with the Main Estimates for fiscal year 2023-24 as well as Supplementary Estimates (A) and Supplementary Estimates (B) for fiscal year 2023-24. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board Policy on Financial Management.

This report has not been subject to an external audit or review.

1.1 Authority, Mandate and Departmental Results

Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) continues to renew the nation-to-nation, Inuit-Crown, government-to-government relationship between Canada and First Nations, Inuit and Métis; modernize Government of Canada structures to enable Indigenous Peoples to build capacity and support their vision of self-determination; and lead the Government of Canada's work in the North.

The responsibility for CIRNAC is shared between the Minister of Crown-Indigenous Relations and the Minister of Northern Affairs.

Further details on CIRNAC's authority, mandate and departmental results can be found in Part II of the Main Estimates and the Departmental Plan.

1.2 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying statement of authorities (Table 1) includes the Department's spending authorities granted by Parliament, and those used by the Department consistent with the Main Estimates and Supplementary Estimates for fiscal year 2023–24. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the full accrual accounting method to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 General Descriptions

The following descriptions are referred to throughout the report:

- Authority: Approvals from Parliament to spend up to a specific amount.

- Operating (Vote 1 and Statutory):

- Vote 1: Amount approved for the fiscal year for the Department to spend on operating expenditures.

- Statutory: Amount approved through an existing Act of Parliament.

- Capital (Vote 5): Amount approved for the fiscal year for the Department to spend on capital purchases or for the construction of assets.

- Grants and Contributions (G&C's) (Vote 10 and Statutory):

- Vote 10: Amount approved for the fiscal year for the Department as Grants and Contributions (G&C's) transfer payments to recipients.

- Statutory: Amount approved through an existing Act of Parliament.

- Standard Object (SO): Classification or coding of transactions to permit the reporting of information about the nature of transactions in the Estimates and Public Accounts. Classifications include, for example, personnel, professional and special services, and transfer payments.

- Government Contingencies (TB Vote 5): Temporary advances for urgent or unforeseen items that require funding in advance of the next Supplementary Estimates and related Supply bill.

- Operating and Capital Carry Forward: Eligible funds lapsed in the previous fiscal year brought forward to the following year.

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

2.1 Authorities available for use

This section highlights the financial results for the quarter and fiscal year-to date ended December 31, 2023, and provides an explanation of variances in authorities available for use compared to the same period in the prior year.

CIRNAC's total budgetary authorities available for use at the end of the third quarter in 2023-24 is $26,473.9 million which is comprised of the Department's 2023-24 Main Estimates of $9,133.1 million, Supplementary Estimates (A) of $8,223.2 million, Supplementary Estimates (B) of $9,079.0 million and $38.6 million in allotment adjustments, which includes items such as the Operating and Capital Budget Carry Forwards. The most significant adjustment that was made to CIRNAC's authority during the third quarter was the Supplementary Estimates (B), which funded key initiatives, including:

- $5,000.0 million for the Restoule Settlement Agreement;

- $1,586.6 million to settle land related claims and litigation;

- $651.2 million for Federal Indian Day Schools Settlement (McLean);

- $596.0 million for the Specific Claim Settlement Fund;

- $593.2 million for Compensation Related to Losses Incurred Through the Diminishing Purchasing Power of Annuity Payments with Treaty 8 First Nations; and,

- $204.0 million to resolve the Lac Seul First Nation's Treaty 3 Flooding specific claim and associated litigation.

2.1.1 Highlights of changes in authorities available for use (2023-24 compared to 2022-23)

At the end of the third quarter in 2023-24, CIRNAC's total budgetary authorities available for use is $26,473.9 million which is $12,809.5 million (94%) higher than the same period in 2022-23. The increase in authorities can be mainly attributed to:

- Funding for the Restoule Settlement Agreement (+$5,000.0 million)

- Funding to Implement the Expedited Resolution Strategy for Agricultural Benefits Claims (+$4,063.0 million);

- Funding for the Specific Claims Settlements (+$2,066.4 million); and

- Funding to settle land related claims and litigation (+$1,586.6 million).

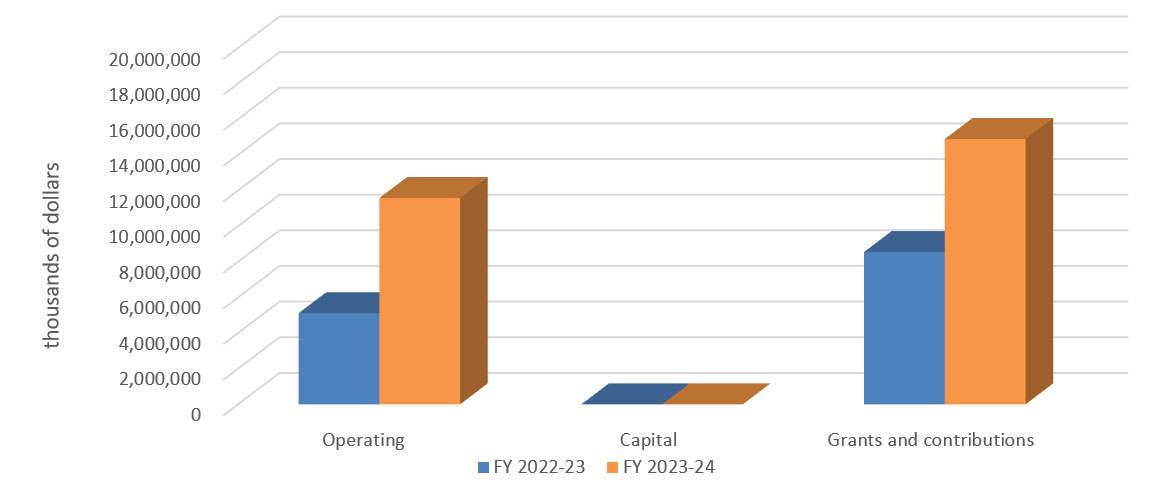

The changes in authorities available for use are illustrated in Graph 1 below.

Text alternative for Comparaison of Authorities Available as December 31, 2023

| Fiscal Year | OperatingTable note 1 | Capital | Grants and ContributionsTable note 1 | Total |

|---|---|---|---|---|

| 2023-24 | 11,580,887 | 224 | 14,892,750 | 26,473,861 |

| 2022-23 | 5,116,421 | 547 | 8,547,390 | 13,664,357 |

| Variance | 6,464,466 | (323) | 6,345,360 | 12,809,504 |

See Table 1: Statement of Authorities and Table 2: Departmental Budgetary Expenditures by Standard Object for additional details.

2.2 Authorities used and actual expenditures

Actual expenditures during this quarter were $1,701.2 million, mainly due to the following:

- Operating expenditures related to payments for the remediation and care and maintenance of contaminated sites ($207.6 million) and for the Federal Indian Day School (McLean) settlement ($200 million); and

- Grants and Contributions payments for the settlement of specific claims ($566 million), payments to Self-government agreements ($317.5 million) and for the agricultural benefits specific claims ($150.0 million).

CIRNAC's year to date expenditures for the quarter ended December 31, 2023, was $8,114.1 million as compared to $6,022.5 million last year for the same period, representing an increase of $2,091.6 million (35%). The variance can be mainly attributed to the following:

- An increase in operating expenditures due to the payment for the Gottfriedson Band Class Settlement Agreement (+$2,796.0 million)

- A decrease in Grants and Contributions expenditures (-$538.0 million). This is mostly related to an $863.0 million decrease in specific claim settlements, offset by a $296.0 million increase in payments for the comprehensive land claims and self-government agreements.

See Table 1: Statement of Authorities and Table 2: Departmental Budgetary Expenditures by Standard Object for additional details.

3. Risks and Uncertainties

The Department has in place risk management processes and oversight mechanisms to identify, assess and address strategic, operational and financial risks at the corporate, sectoral, region and program entity level. Risk mitigation activities are in place or in development to protect the Department from exposure to these risks and the associated financial impacts. Internal controls are in place within the Department, and are subject to ongoing monitoring, to effectively manage financial risks including the risks related to cyber security.

A substantial portion of CIRNAC's expenditures represents grants and contributions to Indigenous and Northern recipients. CIRNAC receives services from Indigenous Services Canada under a shared services structure with respect to the accounting and payment processing of grants and contributions. Through its shared services, Indigenous Services Canada continues to conduct risk-based recipient and project audits under the applicable terms of funding agreements, as an opportunity to provide assurance on management practices and internal controls in place within funding recipients organizations.

4. Significant changes in relation to Operations, Personnel and Programs

In terms of changes in personnel during this quarter, the following appointments have been made:

- Valerie Gideon was appointed as Deputy Minister of Crown-Indigenous Relations and Northern Affairs Canada, effective November 25, 2023; and,

- Paula Isaak retired on December 29, 2023 as Associate Deputy Minister of Crown-Indigenous Relations and Northern Affairs Canada.

5. Approval by Senior Officials

Approved, as required by the Treasury Board Policy on Financial Management:

___________________________________

James Clarkin

Acting Chief Finances, Results and Delivery Officer

Crown-Indigenous Relations and Northern Affairs Canada

Date: February 13, 2024

City: Gatineau (Canada)

___________________________________

Valerie Gideon

Deputy Minister,

Crown-Indigenous Relations and Northern Affairs Canada

Date: February 19, 2024

City: Gatineau (Canada)

| Fiscal year 2023-24 | Fiscal year 2022-23 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2024Table note * | Used during the quarter ended December 31, 2023 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2023Table note * | Used during the quarter ended December 31, 2022 | Year to date used at quarter-end | |

| Vote 1- Operating expenditures | 11,548,095 | 453,668 | 4,325,960 | 5,085,062 | 609,901 | 1,080,533 |

| Vote 5- Capital expenditures | 224 | 0 | 0 | 547 | 24 | 84 |

| Vote 10- Grants and contributions | 14,888,624 | 1,239,489 | 3,759,724 | 8,543,264 | 934,576 | 4,297,264 |

| S-Budgetary statutory authorities - Operating Expenditures: | ||||||

| Contributions to employee benefit plans | 30,722 | 7,383 | 22,151 | 29,292 | 6,227 | 18,679 |

| Minister of Crown-Indigenous Relations – Salary and motor car allowance | 95 | 26 | 73 | 93 | 23 | 69 |

| Minister of Northern Affairs – Salary and motor car allowance | 95 | 23 | 71 | 93 | 23 | 69 |

| Payments to comprehensive claim beneficiaries in compensation for resource royalties | 1,865 | 0 | 0 | 1,866 | 0 | 0 |

| Grassy Narrows and Islington Bands Mercury Disability Board | 15 | 0 | 0 | 15 | 0 | 0 |

| Other | 0 | 636 | 773 | 0 | 0 | 620,559 |

| Total S-Budgetary authorities | 26,469,735 | 1,701,225 | 8,108,752 | 13,660,232 | 1,550,774 | 6,017,257 |

| S-Budgetary statutory authorities - Transfer Payments: | ||||||

| Grants to Aboriginal organizations designated to receive claim settlement payments pursuant to Comprehensive Land Claim Settlement Acts | 4,126 | 0 | 5,380 | 4,126 | 0 | 5,201 |

| Total Budgetary Authorities | 26,473,861 | 1,701,225 | 8,114,132 | 13,664,358 | 1,550,774 | 6,022,458 |

| Non-Budgetary Authorities: | ||||||

| Loans to native claimants | 25,903 | 1,441 | 3,159 | 25,903 | 1,810 | 2,804 |

| Total Non-Budgetary Authorities | 25,903 | 1, 441 | 3,159 | 25,903 | 1,810 | 2,804 |

| Total Authorities | 26,499,764 | 1,702,666 | 8,117,291 | 13,690,261 | 1,552,584 | 6,025,262 |

| Note: Due to rounding, figures may not add to totals shown. | ||||||

| Fiscal year 2023-24 | Fiscal year 2022-23 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2024 | Expended during the quarter ended December 31, 2023 | Year to date expended at quarter-end | Planned expenditures for the year ending March 31, 2023 | Expended during the quarter ended December 31, 2022 | Year to date expended at quarter-end | |

| Expenditures: | ||||||

| 1. Personnel | 253,735 | 80,002 | 203,173 | 219,761 | 58,253 | 170,790 |

| 2. Transportation and communications | 6,451 | 1,800 | 4,384 | 4,730 | 1,691 | 2,944 |

| 3. Information | 7,244 | 59 | 329 | 6,915 | 37 | 161 |

| 4. Professional and special services | 642,305 | 136,542 | 268,892 | 472,304 | 90,347 | 167,482 |

| 5. Rentals | 15,158 | 845 | 2,393 | 10,620 | 1,552 | 5,505 |

| 6. Purchased repair and maintenance | 2,740 | 882 | 927 | 2,620 | 82 | 139 |

| 7. Utilities, materials and supplies | 2,021 | 71 | 248 | 1,899 | 111 | 308 |

| 8. Acquisition of land, buildings and works | 154 | 0 | 0 | 204 | 14 | 21 |

| 9. Acquisition of machinery and equipment | 70 | 736 | 887 | 343 | 63 | 250 |

| 10. Transfer payments | 14,892,750 | 1,239,489 | 3,765,104 | 8,547,391 | 934,576 | 4,302,465 |

| 11. Public debt charges | 0 | 0 | 0 | 0 | 0 | 0 |

| 12. Other subsidies and payments | 10,689,358 | 261,273 | 3,888,269 | 4,430,638 | 464,909 | 1,373,254 |

| Total gross budgetary expenditures | 26,511,986 | 1,721,699 | 8,134,606 | 13,697,425 | 1,551,635 | 6,023,319 |

| Less: Revenues netted against expenditures | ||||||

| Internal Services | (38,125) | (20,474) | (20,474) | (33,067) | (861) | (861) |

| Total Revenues netted against expenditures | (38,125) | (20,474) | (20,474) | (33,067) | (861) | (861) |

| Total net budgetary expenditures | 26,473,861 | 1,701,225 | 8,114,132 | 13,664,358 | 1,550,774 | 6,022,458 |

| Note: Due to rounding, figures may not add to totals shown. | ||||||