Audit of the Oversight Mechanisms for Self-Government Financial Mandating

December 2022

Internal Audit Report

Prepared by: Audit and Assurance Services Branch

PDF Version (582 KB, 31 pages)

Table of Contents

Acronyms

- AFP

- Annual Fiscal Plan

- ADM

- Assistant Deputy Minister

- CFO

- Chief Financial Officer

- CFRDO

- Chief Finances, Results and Delivery Officer

- CIRNAC

- Crown-Indigenous Relations and Northern Affairs Canada

- FDDIPI

- Final Domestic Demand Implicit Price Index

- FSU

- Funding Services Unit

- FTA

- Fiscal Transfer Agreement

- IB

- Implementation Branch

- ILA

- Interdepartmental Letter of Agreement

- IS

- Implementation Sector

- ISC

- Indigenous Services Canada

- OGD

- Other Government Department

- SGIG

- Self-Governing Indigenous Government

- TAG

- Treaties and Aboriginal Government

- TB

- Treasury Board

- TBS

- Treasury Board Secretariat of Canada

- TMD

- Treaty Management Directorate

Executive Summary

Context

The Government of Canada continues to prioritize reconciliation with Indigenous peoples. Advancing Indigenous self-determination and self-government is one of the ways the federal government is working towards a renewed relationship with Indigenous peoples. Self-government agreements are negotiated between Indigenous governments and Canada and recognize authority for Indigenous governments to create their own laws and policies. They have broader expenditure responsibilities and obligations than First Nations under the Indian Act and Inuit and Métis groups without self-government arrangements. Ultimately, Self-Governing Indigenous Governments (SGIGs) have decision-making power to determine how programs and services should be delivered to their citizens, including in the areas of land and resource management, heritage and culture, social services, health, capital and community infrastructure, economic development, and education.

Canada's Collaborative Self-Government Fiscal Policy addresses the fiscal relationship between Canada and SGIGs and is intended to guide federal officials in developing fiscal agreements between Canada and each Indigenous Government. The policy was co-developed in collaboration with SGIGs with the intent to provide sufficient fiscal resources to Indigenous governments to fulfill their responsibilities and to provide public services that are reasonably comparable to those available to other Canadians, while supporting measures to help close the social well-being gaps between Indigenous and non-Indigenous peoples.

A financial mandate provides the authority to negotiate financial elements of an agreement and to table a financial offer within a limit and/or pursuant to a methodology specified in that mandate.

The initial step of the financial mandating process occurred in 2019 Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) was authorized to implement the new policy through negotiation of Fiscal Transfer Agreement (FTA) renewals with 25 SGIGs. Next, after securing Treasury Board approval of the methodologies to be used in negotiations and the specific financial mandate for each of the 25 agreements in 2019, CIRNAC expedited the conclusion of negotiations with 25 SGIGs. Finally, CIRNAC entered into renewal FTAs with 24 SGIGs between August and September 2019 and the 25th renewal FTAs was executed in March 2020. The total cost required to renew the 25 agreements is up to $2.1 billion over five (5) years (2019-20 to 2023-24) and $444 million ongoing.

In the process of implementing the mandate for renewal FTAs, errors and omissions were found in the information used to develop ten of the detailed financial mandate proposals provided to Treasury Board (TB). CIRNAC proposed revisions to the mandate for FTA with ten (10) SGIG totaling $3.5M, therefore changing the 2019 TB mandate amount of $409M to $412.5M (0.85%). As part of its approval for CIRNAC to implement measures to correct these errors, Treasury Board Secretariat of Canada (TBS) required CIRNAC to conduct an audit of the oversight mechanisms for self-government financial mandating and provide TB with audit findings no later than March 2024.

Why It Is Important

The total cost to fund the 25 FTAs (following renewal) is estimated to be $2.1 billion over five (5) years (2019-20 to 2023-24) and $444 million ongoing. This represents a significant material cost and due diligence is required to ensure that funding amounts are accurate and determined by an approved approach. Further, relationship building with SGIGs is a critical element to maintaining an effectively administered program. The existence of errors and omissions in these agreements that may impact the funding the SGIGs receive could cause reputational damage to the Department and strain the relationship with SGIGs. Therefore, it is critical that effective oversight mechanisms to identify potential errors and omissions in FTA are designed and operating effectively to limit this risk.

What We Examined

The audit objective was to provide assurance on the adequacy and implementation of oversight controls in the self-government financial mandating process. The scope of the audit examined three sub-processes within the broader self-government financial mandating process: renewals of existing self-government FTAs; annual updates of funding schedules for self-government activities; and annual amendments to existing FTAs.

What We Found

Positive Observations

During the audit, positive observations were identified, including the following:

- Tools and information sources in the three sub-processes have been identified and are being leveraged consistently.

- For the two sub-processes for the annual updates of funding schedules for self-government activities and the annual amendments to the FTAs, the key controls that could be assessed were in place and operating effectively. The audit did not identify any design gaps in the key controls.

Opportunities for Improvement

Areas where management control practices and processes could be improved were identified, resulting in the following recommendations:

- The Assistant Deputy Minister of Implementation Sector should develop, to support the renewal sub-processes, standard processes and tools to collect and document information on each Self-Governing Indigenous Government, self-government agreement and fiscal transfer agreement and make it available for the analysis and calculation of funding obligations.

- The Assistant Deputy Minister of Implementation Sector should design then implement controls to validate the sector's work when applying new expenditure methodologies and other changes to support a reconciliation with the prior funding amounts for each Self-Governing Indigenous Government. The process should include review and approval by appropriate internal participants (e.g., Funding Services Unit Manager, Treaty Management Directorate Directors, etc.).

- The Assistant Deputy Minister of Implementation Sector should leverage the process maps and narratives developed by Internal Audit to define and keep updated documentation of the processes including the reviews and authorizations, steps, controls, and roles and responsibilities. This should be done for the following sub-processes:

- The renewal sub-process;

- The preparation and review of the Annual Fiscal Plan sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

- The Assistant Deputy Minister of Implementation Sector should strengthen the use of control features within its Excel spreadsheets. This should be done for the following sub-processes:

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

- The Assistant Deputy Minister of Implementation Sector should develop guidance materials on the use of tools and information sources. This should be done for the following sub-processes:

- The renewal sub-process;

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

- The Assistant Deputy Minister of Implementation Sector should establish a formal standard for the documentation required to be retained to demonstrate that control activities have been carried out. This should be done for the following sub-processes:

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

Overall Conclusion

The self-government financial mandating process, specifically the three in-scope sub-processes (i.e., the renewal of existing self-government FTAs; the annual update of funding schedules for self-government activities; and the annual amendments to existing fiscal transfer agreements), is highly complex. This complexity is driven by multiple factors, including the multi-stakeholder environment surrounding the self-government financial mandating process; the introduction of new policy (e.g., Canada's Collaborative Self-Government Fiscal Policy) and associated expenditure need methodologies; and the fact that each negotiation, FTA, and relationship with a given SGIG is unique and must be managed accordingly. Lastly, the required flexibility and variability of these sub-processes (i.e., the process flow can be altered upon request or recommendation of Central Agencies) contributes to the complexity by making it challenging to document processes in a consistent manner as well as corresponding process guidance.

To understand the three sub-processes and to identify and evaluate the controls in these sub-processes, the audit team developed process maps and supporting narratives for the three in-scope sub-processes which can be leveraged by the Implementation Branch for the purposes of process improvement.

Overall, the audit concluded that the design of most controls was strong. There were adequate oversight controls in place in the three in-scope sub-processes; however, the performance of some controls was not documented.

Statement of Conformance

The audit conforms with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and the Government of Canada's Policy on Internal Audit, as supported by the results of the Quality Assurance and Improvement Program.

Management's Response

Management is in agreement with the findings, has accepted the recommendations included in the report, and has developed a management action plan to address them. The management action plan has been integrated into this report.

1. Context

The Government of Canada continues to prioritize reconciliation with Indigenous peoples. Advancing Indigenous self-determination and self-government is one of the ways the federal government is working towards a renewed relationship with Indigenous peoples. Self-Government Agreements are negotiated between Indigenous governments and Canada and recognize authority for Indigenous governments to create their own laws and policies. They have broader expenditure responsibilities and obligations than First Nations under the Indian Act and Inuit and Métis groups without self-government arrangements. Ultimately, Self-Governing Indigenous Governments (SGIGs) have decision-making power to determine how programs and services should be delivered to their citizens, including in the areas of land and resource management, heritage and culture, social services, health, capital and community infrastructure, economic development, and education. Each Self-Government Agreement is supported by a Fiscal Transfer Agreement (FTA) that defines the grants that will be made to each SGIG.

1.1 Canada's Collaborative Self-Government Fiscal Policy

Canada's Collaborative Self-Government Fiscal Policy addresses the fiscal relationship between Canada and SGIGs and is intended to guide federal officials in developing fiscal agreements between Canada and each Indigenous Government. The policy was co-developed in collaboration with SGIGs with the intent to provide sufficient fiscal resources to Indigenous governments to fulfill their responsibilities and to provide public services that are reasonably comparable to those available to other Canadians, while supporting measures to help close the social well-being gaps between Indigenous and non-Indigenous peoples. The goal of the policy is to strengthen the government-to-government partnership and better support self-government arrangements by providing sufficient, predictable, and sustained funding so SGIGs have the means and fiscal capacity to govern effectively.

To determine the expenditure need (i.e., a measure of the estimated cost of performing a set of services, functions, or activities to meet a set of responsibilities, based on comparative measures or standards) of a SGIG in an objective and systematic way, the policy calls for the development and implementation of a series of expenditure need costing methodologies. This is to ensure the variation in organizational structures, services, and programs that are delivered by different SGIGs are fairly captured. The majority of the costing methodologies are still under development through the collaborative fiscal process; however, during the 2019 renewal of existing self-government FTAs, the Governance and Administration model was fully developed and implemented.

The policy also outlines how fiscal transfer amounts are adjusted for the life of a fiscal agreement (or the funding schedule) to take account of changes in price, population, and other volume or workload measures. All existing self-government FTAs annually apply some adjustors for price and/or volume (i.e., population).

1.2 Overview of the Implementation Branch

Implementation Branch within the Implementation Sector (IS) is primarily responsible for federal implementation of modern treaty, self-government, sectoral, incremental, and settlement agreements. Additionally, Implementation Branch supports Treaties and Aboriginal Government (TAG) Sector and Other Government Departments (OGD) in the negotiation of agreements.

Implementation Branch is comprised of:

- The Fiscal Operations Directorate, which includes the Funding Services Unit (FSU) – The FSU is responsible for funding agreement management as well as process improvement and corporate reporting. The FSU was created to centralize funding services functions within IS, allowing for increased efficiencies and standardization. The FSU also serves as the main center of knowledge and expertise for agreement and funding management in the sector.

- Treaty Management Directorates (TMDs) – There are three TMDs: British Columbia, East, and West. They are each responsible for implementation negotiation and implementating self-government agreements in their respective regions.

1.3 Self-Government Financial Mandating Process

A financial mandate provides the authority to negotiate financial elements of an agreement and to table a financial offer and seek required appropriations within a limit and/or pursuant to a methodology specified in that mandate.

There are four key sub-processes within the self-government financial mandating process. They are as follows:

- Negotiation of new self-government agreements and their associated fiscal transfer agreements: TAG is normally responsible for seeking the mandate and source of funds through Central Agencies for new self-government agreements and for preparing the associated Treasury Board (TB) Submission, finalizing negotiations with Indigenous partners, and drafting and finalizing the associated initial FTA.

- Renewals of existing self-government fiscal transfer agreements: FTAs with SGIGs are typically renewed every five (5) years and are the responsibility of the IS. This sub-process involves seeking a financial mandate to negotiate renewal agreements, a Submission to secure authorities and finalize negotiations, and the execution of the renewal agreement by duly authorized representatives of all parties to that agreement.

- Annual update of funding schedules for self-government activities: The FSU prepares and provides the Annual Fiscal Plan (AFP) to Treaty Management Directorates to share with SGIGs, the AFP summarizes the funding amount to be expected for the following fiscal year, accounting for any adjustors. The FSU is also responsible for calculating and requesting any additional funding for the adjustors through the Annual Reference Level Update and Supplementary Estimates processes.

- Annual amendments to existing fiscal transfer agreements: The Treaty Management Directorates in collaboration with the FSU are responsible for developing annual amendments to existing FTAs. As part of this process, the FSU is responsible for preparing updated Annual Fiscal Plans to incorporate any funding for SGIGs that may be transferred from OGDs through supplementary estimates or any funding for SGIGs that results from other TB Submissions for the Department.

In each sub-process, CIRNAC must request additional funding from central agencies, to be able to enter into agreements with and/or make payments to individual SGIGs.

1.4 The 2019 Renewal of Self-Government Fiscal Transfer Agreements

The initial step of the financial mandating process occurred in 2019, when CIRNAC was authorized to implement the new Canada's Collaborative Self-Government Fiscal Policy through negotiations of FTA renewals with 25 SGIG. As a second step, in 2019, the Assistant Deputy Minister (ADM) of Implementation Sector completed a letter exchange with central agency counterparts to confirm a mandate for renewal agreements with 25 SGIGs. Next, after securing Treasury Board (TB) approval to seek the appropriations required to implement the methodologies to be used in negotiations and the specific mandate for each of the 25 agreements in 2019, CIRNAC expedited the conclusion of negotiations with 25 SGIGs. Finally, CIRNAC entered into renewal agreements with 24 SGIGs between August and September 2019 and entered into a renewal agreement with the 25th SGIGs in March 2020. Historically, individual FTA renewals could each take a number of years to negotiate and complete. With the new policy and renewal alignment, all 25 FTA renewals were completed between April 1, 2019 and March 31, 2020. Furthermore, instead of having FTA renewal dates staggered over different years, all agreements took effect on April 1, 2019 for a five-year duration. The total cost required to renew the 25 agreements is estimated at up to $2.1 billion over five years (2019-20 to 2023-24) and $444 million ongoing.

In the process of implementing the agreements, errors and omissions were found in the information used to develop ten of the detailed financial mandate proposals prepared by CIRNAC and approved by Treasury Board. CIRNAC accordingly proposed revisions to the mandate for FTAs with ten SGIGs. At the time the revisions to the financial mandate were proposed to TB, changes had already been included in three FTAs, while the remaining agreements required further amendments. In addition to the errors and omissions, three executed renewal agreements included amounts that were less than those authorized by TB. The differences affected CIRNAC's required appropriations relative to the existing financial mandate for this initiative.

As a result of the errors and omissions detailed above, CIRNAC proposed to amend the renewal agreements by a total of $3.5M, therefore changing the July 2019 TB mandate amount of $409M to $412.5M. This change represents a total of 0.85% of the July 2019 TB mandate amount signaling that the materiality of these amendments was minor.

As part of its approval for CIRNAC to implement measures to correct these errors, TB required CIRNAC to conduct an audit of the oversight mechanisms for self-government financial mandating and provide TB with audit findings no later than March 2024. CIRNAC confirmed with TBS that the Department has considerable discretion to determine the scope of the required audit, provided that the focus remains on the oversight mechanisms for financial mandating for the 25 groups that renewed FTAs in 2019–2020.

2. About the Audit

The Audit of the Oversight Mechanisms for Self-Government Financial Mandating was included in the Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) and Indigenous Services Canada (ISC) Risk-Based Audit Plan for 2021-22 to 2022-23 that was presented to the Departmental Audit Committee and then approved by the Deputy Minister in June 2021.

2.1 Why It Is Important

The negotiation and implementation of self-government Fiscal Transfer Agreement (FTA) is one mechanism through which CIRNAC operationalizes its mandate to renew the nation-to-nation, Inuit-Crown, government-to-government relationship between Canada and First Nations, Inuit, and Métis; modernize Government of Canada structures to enable Indigenous peoples to build capacity and support their vision of self-determination; and lead the Government of Canada's work in the North. Under self-government arrangements, Self-Governing Indigenous Government (SGIG) take on both the general costs of operating their governments and the jurisdiction to provide programs and services transferred from Canada to the Indigenous government.

The total cost to fund the existing 25 agreements is up to $2.1 billion over five (5) years (2019-20 to 2023-24) and $444 million ongoing. This represents a significant material cost and due diligence is required to ensure that funding amounts are accurate and determined by an approved approach. Further, relationship building with SGIGs is a critical element to maintaining an effectively administered program. The existence of errors and omissions in these fiscal agreements that may impact the funding the SGIGs receive could cause reputational damage to the Department and strain the relationship with SGIGs. Therefore, it is critical that effective oversight mechanisms (i.e., controls) to identify potential errors and omissions in FTAs are designed and operating effectively to limit this risk.

Lastly, Treasury Board (TB) required CIRNAC to conduct an audit of the oversight mechanisms for self-government financial mandating and provide TB with audit findings no later than March 2024 as a condition for the approval of measures to correct aforementioned errors and omissions identified in the 2019 renewal process.

2.2 Audit Objective

The audit objective was to provide assurance on the adequacy and implementation of oversight controls in the self-government financial mandating process.

2.3 Audit Scope

The scope of the audit included three of the four sub-processes within the self-government financial mandating process:

- Renewal of existing self-government fiscal transfer agreements

- Annual updates of funding schedules for self-government activities

- Annual amendments to existing fiscal transfer agreements

The audit focused on these three sub-processes, and not only the renewal sub-process in which the 2019 errors and omissions were identified, because the sub-processes to make the annual updates to funding schedules and prepare the annual amendments reflect the controls that have been put in place since the identification and rectification of the errors and omissions. They are also the sub-processes by which the financial mandates are implemented, making up critical components of the overall self-government financial mandating process.

For the latter two sub-processes, the audit examined the controls over the development of the funding amounts for individual agreements and the controls leading to the request and receipt of funding to CIRNAC before entering into amended agreements. Controls testing on the renewal sub-process was not undertaken because (1) there have been no additional use of this sub-process since the 2019/20 errors and omissions; (2) the root-causes of these errors and omissions have been well-documented meaning that re-testing these files would not add value; and (3) an in-depth knowledge of the unique aspects of each agreement is required to detect additional unknown errors such as the ones identified in 2019/20. Instead, the renewal sub-process testing was limited to confirming that the financial amounts that were approved by TB were accurately reflected in the signed FTA and Annual Fiscal Plans.

Exclusions

The negotiation of new self-government agreements and their associated FTA were excluded from the audit because no new agreements have been established since 2019.

The focus of the audit was on financial mandating and approval of funding. It did not extend to testing the Section 34 and Section 33 controls over payments made to recipients or the controls in the GCIMS and SAP systems.

The development of the expenditure need-based methodologies was excluded from the audit because this policy work has not been fully completed.

Sampling Plan

Using a targeted sampling approach, ten of the 25 self-government FTAs (40%) were selected to test that the key controls in the annual updates of funding schedules and annual amendments sub-processes were operating effectively.

As discussed above, of the 25 self-government FTAs which were renewed in 2019, errors or omissions were identified in the amounts for ten agreements after the funding request had been submitted to Treasury Board for approval. Of these ten agreements, six agreements are very similar and had a similar error. The remaining four agreements with errors or omissions and one of the six similar agreements were selected for the sample. A further five agreements that did not have errors or omissions in 2019 were selected using considerations such as large dollar amounts, other differences in 2019, issues noted in 2020, and a judgmental selection from remaining agreements. These 10 sample items cover $262 million (62%) of the $424 million in total funding provided through self-government agreements (negotiated funding and funding from Other Government Department (OGD) and other ISC and CIRNAC programs) in 2020.

To test the annual amendment sub-process, three sources of funding were selected that provided additional funding to all or most of the ten recipients selected above. These were:

- Closing the Gap funding that was approved in 2019 for the 25 SGIG as part of the implementation of the Collaborative Self-Government Fiscal Policy;

- Indigenous Community Infrastructure Fund established by CIRNAC and ISC in 2021-22; and

- Indigenous Skills and Employment Training Enhancement funding transferred from Employment and Social Development Canada to CIRNAC in 2021-22.

Testing the sub-process of making annual updates to funding schedules for self-government activities included testing of the 2021-22 annual updates for all ten sample agreements. Testing the amendment sub-process included the amendments to add the funding referred to above in 2022 as applicable to the ten sample agreements, and the amendments for the Closing the Gap funding for all ten sample agreements.

2.4 Audit Approach and Methodology

The audit was conducted in accordance with the requirements of the Treasury Board Policy on Internal Audit and followed the Institute of Internal Auditors International Professional Practices Framework. The audit examined sufficient, relevant evidence and obtained sufficient information to provide a reasonable level of assurance in support of the audit conclusion.

The audit fieldwork was performed from March 2022 to August 2022 and consisted of three phases: planning, conduct and reporting. The main audit techniques used included:

- Interviews with key stakeholders;

- Process walkthroughs and process map development;

- Review of relevant documentation, including self-government agreements, their associated FTA, and any amendments;

- Analysis of the nature and source of errors in the relevant TB submission;

- File testing to test whether key preventative and detective oversight controls are in place and operating effectively; and

- Follow up meetings to validate preliminary testing observations.

The approach used to address the audit objective included the development of audit criteria, against which observations and conclusions were drawn. The audit criteria can be found in Annex A.

3. Key Findings and Recommendations

3.1 Renewal of Existing Self-Government Fiscal Transfer Agreements

Background

In 2019, all 25 Fiscal Transfer Agreement (FTA)s were renewed to implement the Governance and Administration expenditure need model, standardize adjustors, and make other changes consistent with the new Collaborative Self-Government Fiscal Policy. The analysis to calculate the impact of these changes was complex because the original self-government agreements had been negotiated at different points in time and each agreement covered up to thirteen different areas of self-government.

The renewal sub-process required Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) to seek approval of a mandate proposal, including an estimate of the total financial impact of the renewals prior to the start of negotiations. At the conclusion of negotiations, CIRNAC prepared a Treasury Board (TB) Submission to request spending authorities to satisfy the obligations that arose within each of the renewed FTA. It was in the preparation of the TB Submission details that the 2019 renewal errors materialized.

The audit expected to find a defined and documented renewal sub-process, supported by tools and information sources including the associated guidance, with controls in place to reduce the likelihood of errors and omissions in the agreements and in the resulting funding requests.

Risk

There is a risk that without a documented process, including preventative and detective controls, supported by tools and information sources, errors and omissions could occur during the renewal sub-process. This could result in funding requests to central agencies which are inconsistent with the amounts due to meet the federal obligation to Self-Governing Indigenous Government (SGIG) under FTA.

Finding

3.1.1 Sub-Process of Renewing Existing Fiscal Transfer Agreements

CIRNAC made a mandate request for the authority to apply new co-developed fiscal methodologies when renewing the SGIGs' FTAs. Once the negotiations of the FTA were substantially complete, CIRNAC made a request to TB for the funding necessary to enter into agreements with the SGIGs. The processes to develop, review, and authorize the financial aspects of these requests, including steps, controls, and roles and responsibilities were not documented.

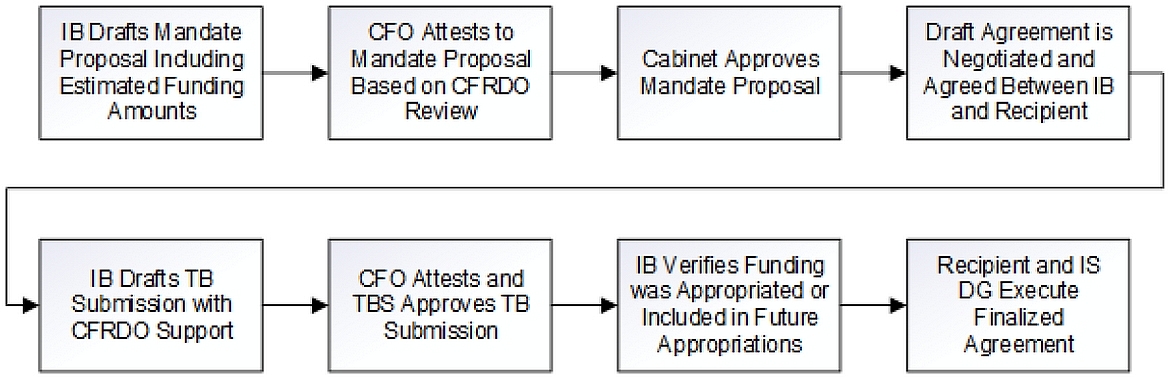

To support an assessment of controls, the audit team developed a process map to capture the steps, controls and roles and responsibilities that were carried out by key stakeholders in the sub-process for financial mandating for renewal agreements. The development of a process map also included identification of key controls that were in place to prevent and detect errors in the sub-process. Figure 1 provides a summary of the sub-process of renewing existing fiscal transfer agreements:

Text alternative for Figure 1 Overview of the Renewal Sub-Process

Figure I provides an overview of the sub-process of renewing existing fiscal transfer agreements.

The steps illustrated in the process diagram are as follows:

- Implementation Branch (IB) Drafts Mandate Proposal Including Estimated Funding Amounts

- Chief Financial Officer (CFO) Attests to Mandate Proposal Based on Chief Finances, Results and Delivery Officer (CFRDO) Review

- Cabinet Approves Mandate Proposal

- Draft Agreement is Negotiated and Agreed Between IB and Recipient

- IB Drafts TB Submission with CFRDO Support

- CFO attests and Treasury Board Secretariat of Canada (TBS) Approves TB Submission

- IB Verifies Funding was Appropriated or Included in Future Appropriations

- Recipient and Implementation Sector (IS) Director General (DG) Execute Finalized Agreement

The lack of a formally documented renewal sub-process is a result of the complexity of the broader self-government financial mandating process. The sub-process involves multiple stakeholders and review points as the agreements have a high monetary value. The overall sub-process may also vary based on requests or recommendations from Central Agencies. However, having a strong internal analysis and documentation of the steps, controls, and roles and responsibilities before the start of the next renewal period in 2024 would support an orderly and effective sub-process. Without a formally documented sub-process to guide future renewal efforts, operations may be disrupted or delayed. If the process is not communicated or well understood, then errors or omissions may occur and corporate knowledge may be lost with employee turnover.

See Recommendation #3 in Section 3.3.1 below to address the lack of a formally documented renewal sub-process.

3.1.2 Tools and Information Sources Used in the Renewal of Existing Fiscal Transfer Agreements and the Associated Guidance

Detailed Excel spreadsheets were the tools used to develop the financial information to be included in each FTA and in the requests to TBS for the financial mandate. These spreadsheets included detailed calculations for each SGIG to apply the Governance and Administration expenditure need model.

The information sources available for the development of the financial calculations in support of the renewals were prior self-government FTA and discussions with key stakeholders within CIRNAC. Depending on when previous agreements were developed or last renewed, the detailed information relevant to applying volume adjustors prior to 2019 was not evident in the previous agreements. Additionally, some agreements did not contain information on why other funding outside of the self-government agreement was being added or deducted or did not contain information about the unique aspects of the SGIG that were relevant to the calculation of funding under the FTA. In some cases, digital copies of prior agreements had not been stored centrally making it difficult to access the relevant information. There was no reference source available that documented and explained, in a structured way, the relevant information for each SGIG drawn from the experience of Treaties and Aboriginal Government (TAG) and Treaty Management Directorate (TMD) representatives who had negotiated these agreements and worked with SGIGs over many years.

The audit's analysis of the underlying reasons for the errors and omissions in the 2019 funding request to TB found that errors and omissions arose primarily because information that was relevant to apply adjustors consistently across agreements and to fully incorporate unique aspects of each agreement as it had evolved over time were not documented and available to those involved in calculating the funding request for each FTA.

Overall, the tools and information sources were identified for the renewal sub-process and leveraged by key stakeholders; however, there is no documented guidance to support the application of the tools and information sources used in the renewal sub-process.

The absence of a reference source that documents the relevant information for each SGIG in a structured way results from a lack of an expectation or assigned responsibility for formal documentation of this information. The absence of guidance to support the use of tools and information sources is a result of a lack of formally documented process for the self-government financial mandating process overall. Without a documented source for relevant information or guidance material for the application of tools and information sources in the renewal sub-process, errors or omissions may occur and corporate knowledge may be lost with employee turnover.

Recommendation

1. The Assistant Deputy Minister of Implementation Sector should develop, to support the renewal sub-processes, standard processes and tools to collect and document information on each Self-Governing Indigenous Government, self-government agreement and fiscal transfer agreement and make it available for the analysis and calculation of funding obligations.

See Recommendation #5 in Section 3.3.2 below to address the lack of guidance material for the use of tools and information sources used in the renewal sub-process.

3.1.3 Testing of the Renewal Sub-Process

The audit conducted an analysis of the underlying reasons for the errors and omissions in the funding request to TB. This analysis concluded that the errors and omissions arose from a lack of documentation of the relevant detailed information for each SGIG available to the team developing the underlying calculations for the TB submissions. For example, for one of the SGIGs, the previous agreement provided for governance included a central government and five local governments as a single amount with no explanation. The application of the funding methodology updated the funding for the central organization but the funding for the local governments was omitted in error.

Some of the errors may have been identified earlier if there had been an additional control process and tools in place to conduct an analysis of the application of new expenditure methodologies as well as any other changes during the renewals. This would facilitate a reconciliation analysis with the prior funding amounts for each SGIG. Having this analysis reviewed by key internal participants with knowledge of the previous agreements (e.g., Funding Services Unit (FSU) Manager, TMD Directors, etc.) may have resulted in earlier identification of errors.

Controls testing on the renewal sub-process was not undertaken because (1) there has been no additional use of this sub-process since the 2019-20 renewal; (2) the root-causes of errors and omissions have been well-documented meaning that re-testing these files would not add value; and (3) an in-depth knowledge of the unique aspects of each agreement is required to detect additional unknown errors such as the ones identified in 2019-20.

In the absence of controls testing, the audit included limited substantive testing on the ten sample agreements. For each of these agreements, the audit traced the consistency of the funding amounts at key points in the sub-process:

- The funding request in the 2019 TB Submission matched the detailed financial calculations for the SGIG.

- The amounts in each individual FTA matched the 2019 TB Submission.

- The FTA amounts matched the amounts in the 2019-20 Annual Fiscal Plans (Note: if there was an executed amendment agreement effective retroactively to April 1, 2019, the audit confirmed that the amounts appeared in future years).

Other than the differences previously reported to TB, no discrepancies were found in the amounts included in each of these documents.

Recommendation

2. The Assistant Deputy Minister of Implementation Sector should design and implement controls to validate the sector's work when applying new expenditure methodologies and other changes to support a reconciliation with the prior funding amounts for each Self-Governing Indigenous Government. The process should include review and approval by appropriate internal participants (e.g., Funding Services Unit Manager, Treaty Management Directorate Directors, etc.).

3.2 Annual Updates of Funding Schedules for Self-Government Activities

Background

The sub-process of making the annual updates of funding schedules for self-government activities consists of two primary activities: (1) the preparation and review of the Annual Fiscal Plans (AFP); and (2) calculating and requesting funding for the annual adjustments of the self-government FTA.

Preparation and Review of the Annual Fiscal Plans

The FSU within Implementation Branch prepares and provides the Treaty Management Directorates with an AFP to share with the SGIG to summarize the funding amount to be expected for the following fiscal year, accounting for any adjustors (i.e., for population and price indices) that may need to be applied to the funding amounts. As per the provisions of self-government arrangements and/or Canada's Collaborative Self-Government Fiscal Policy, FTAs with Indigenous Governments are for multi-year periods. For the life of a FTA, Canada may provide that the funding amounts are adjusted annually to take account of changes in price, population, and other volume or workload measures. The FTAs identify what type of funding is subject to increase based on adjustors separate from funding that is not subject to adjustors. For the 25 self-government FTAs, CIRNAC has worked to make the application of adjustors more consistent than previous years by: (1) using the Final Domestic Demand Implicit Price Index (FDDIPI) information from Statistics Canada as the price adjustors; and (2) using total citizen population as the volume adjustor.

The AFPs give SGIGs the opportunity to confirm that financial obligations contained in self-government FTAs are implemented properly each fiscal year and help to ensure that CIRNAC's practices remain consistent with what is outlined in the broader FTA. This sub-process also provides the SGIG with the opportunity to identify any potential concerns with the payment schedule.

Calculating and Requesting Funding for the Annual Adjustments of Self-Government Fiscal Transfer Agreements

As the population and FDDIPI adjustor information is often updated every year, the FSU is also responsible for completing a reconciliation analysis on an annual basis to request any additional funding required to fund the amounts that have increased due to the application of adjustors.

An initial estimate of 3% increase over the prior year funding is included in the Annual Reference Level Update for CIRNAC. Once the AFP has been prepared and approved (i.e., after the initial 3% adjustment amounts have been appropriated), the FSU conducts a reconciliation analysis that involves a comparison of the estimated 3% increase with the actual increase for each agreement. If the total of required adjustments to appropriations exceeds the 3% estimate, additional funding is requested through the Supplementary Estimates process. Once the FSU has completed the reconciliation analysis, it is reviewed by both the program areas and the Chief Finances, Results and Delivery Officer Sector (CFRDO) representatives before a separate Chief Financial Officer (CFO) attestation is made specifically on the adjustors funding request.

For the annual updates of funding schedules sub-process, the audit expected to find a defined and documented sub-process, supported by tools and information sources including the associated guidance, with appropriate preventative and detective controls in place to reduce the likelihood of errors and omissions.

Risk

There is a risk that technical or administrative errors and omissions (e.g., incorrect adjustors applied to funding amounts, incorrect funding amounts being distributed to SGIGs, etc.) will occur.

Finding

3.2.1 Sub-Process of Updating the Funding Schedules for Self-Government Activities

Preparation and Review of the Annual Fiscal Plans

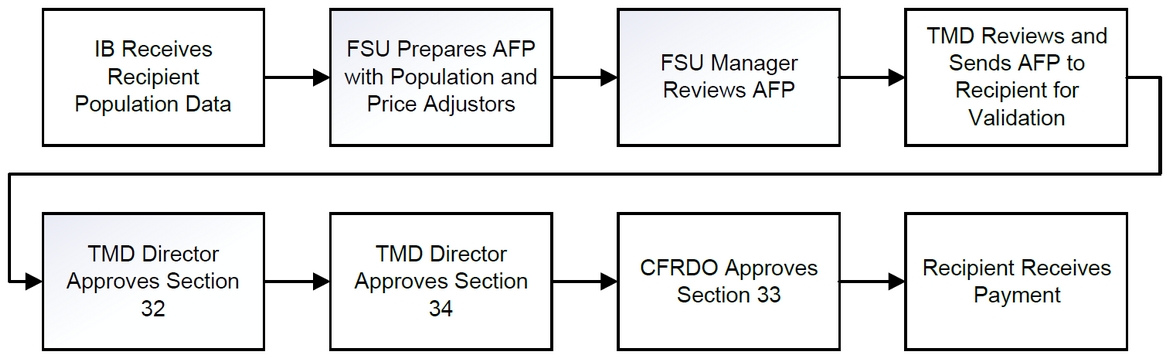

Key stakeholders follow a consistent sub-process every year to develop and review the AFP before payments are made to SGIGs. However, the sub-process, including key roles and responsibilities, has not been formally documented. To support an assessment of controls, the audit developed a process map to capture the activities that are carried out by key stakeholders in the AFP sub-process. The development of a process map also included an identification of key controls that were established by the FSU to prevent and detect errors in the sub-process. Figure 2 provides a summary of this sub-process.

Text alternative for Figure 2 - Overview of the AFP Sub-Process

Figure 2 provides a summary to capture the activities that are carried out by key stakeholders in the AFP sub-process.

The steps illustrated in the process diagram are as follows:

- IB Receives Recipient Population Data

- FSU Prepares AFP with Population and Price Adjustors

- FSU Manager Reviews AFP

- TMD Reviews and Sends AFP to Recipient for Validation

- TMD Director Approves Section 32

- TMD Director Approves Section 34

- CFRDO Approves Section 33

- Recipient Receives Payment

The lack of a formally documented sub-process for the preparation and review of the AFP sub-process is a result of the complexity of the broader self-government financial mandating process. Without a formally documented sub-process, operations may be disrupted or delayed if the sub-process is not communicated or well understood, errors or omissions may occur, and corporate knowledge may be lost with employee turnover.

See Recommendation #3 in Section 3.3.1 below to address the audit's observation of a lack of a formally documented AFP sub-process.

Funding the Annual Adjustments of Self-Government Fiscal Transfer Agreements

The sub-process and methodology to fund the annual adjustments of self-government FTA has been defined and documented in the Comprehensive Claims, Self-Government and Other Constructive Agreements Annual Adjustors Directive. Key roles and responsibilities of the Implementation Sector, the Fiscal Policy Branch within TAG, and the CFRDO Sector, have also been defined in the Directive.

3.2.2 Tools and Information Sources Used in the Annual Updates of Funding Schedules for Self-Government Activities and the Associated Guidance

Preparation and Review of the Annual Fiscal Plans

The primary tools used in the sub-process of preparing and reviewing the AFPs are Excel, GCIMS, and SAP. The Excel tools used in the process were designed by the FSU. The AFPs are updated on an annual basis and funding amounts that require the application of adjustors (i.e., price and population) are calculated directly into the Excel spreadsheets. There is a separate master Excel spreadsheet developed and maintained by the FSU Manager to track all relevant funding appropriated by Parliament to CIRNAC as well as payments to SGIGs. GCIMS is the system of record for the FSU and is the authoritative source for agreement-related documentation and SAP is the system used to issue payments once everything has been approved by CFRDO.

Considering the potential for errors such as unintended entries and faulty calculations when using Excel spreadsheets, the audit reviewed the Excel spreadsheets for use of control features that would limit errors.

The audit observed that the FSU team used access control features in the Excel AFP spreadsheets. While the FSU team has read access to the AFP, only the FSU Manager and the Senior Funding Advisor have edit access. This provides a level of control over changes to the AFP spreadsheets.

Additionally, the audit observed that there is a separate table in each AFP that summarizes the population and price adjustors that are to be used for a particular fiscal year. For each core funding line in the AFP, the Excel formula references the particular cell where the adjustor is stored. The adjustors summary table is not locked (i.e., it can be edited) and an absolute reference to the adjustor cell is not always used. By not using all of the control features available in Excel, there is an increased risk of errors from unintended changes and faulty calculations.

The primary information sources used in the preparation and review of the AFP are the self-government FTA and any associated amendments, population data provided by the SGIG, and the relevant FDDIPI data from Statistics Canada. The FTA and their amendments describe the core funding amounts as well as any non-core funding amounts, often from OGDs or budget announcements, allocated to the respective SGIG. The population data and FDDIPI information are used to adjust core funding amounts year over year.

For the preparation and review of the AFP, there is no guidance available to support the use of tools and information sources.

Funding the Annual Adjustments of Self-Government Fiscal Transfer Agreements

The annual reconciliation analysis completed by the FSU for the calculation and request to TBS for additional funding for the adjustors is completed and maintained in a separate Excel spreadsheet.

Considering the potential for errors such as unintended entries and faulty calculations when using Excel spreadsheets, the audit reviewed the Excel spreadsheets for use of control features that would limit errors.

The audit observed that the reconciliation analysis requires manually inputting the funding and adjustors information from each AFP rather than linking the Excel spreadsheet for reconciliation analysis to the final, approved versions of the AFP to reduce the likelihood of human error in manual entries.

As in the sub-process of preparing and reviewing the AFP, the primary information sources used in funding the annual adjustments are the self-government FTA and any associated amendments, population data provided by the SGIG, and the relevant FDDIPI data from Statistics Canada. The population data and FDDIPI information are used to calculate the adjusted core funding amounts year over year.

For the sub-process of funding the annual adjustments of self-government FTAs, there is no guidance available on the use of specific tools and information sources beyond the high level guidance provided by the Directive.

Overall, the lack of documented guidance to support the use of tools and information sources in the annual updates to funding schedules sub-process is a result of a lack of formally documented process for the self-government financial mandating process overall. This can make it difficult for internal stakeholders to understand how tools and information sources are used in the annual updates to funding schedules sub-process in an effective and efficient way. Without documented guidance for the application of tools and information sources, errors or omissions may occur, and corporate knowledge of the sub-process and tools may be lost when there is employee turnover.

See Recommendation #4 in Section 3.3.2 below to address the use of control features in Excel to limit errors in the annual updates of funding schedules for self-government activities sub-process.

See Recommendation #5 in Section 3.3.2 below to address the lack of guidance material for the use of tools and information sources used in the annual updates of funding schedules for self-government activities sub-process.

3.2.3 Preventative and Detective Controls in the Annual Preparation and Review of the Annual Fiscal Plans

The following table summarizes the key controls in the AFP sub-process that the audit identified as well as the results from testing the operating effectiveness of these controls, based on the selected sample of 10 agreements. The audit found that several key controls in the sub-process of preparing and reviewing the AFP were implemented and operating effectively; however, there were specific instances when the implementation of the key control could not be assessed due to lack of documentation. The audit did not identify any design gaps or weaknesses in the key controls.

| Key Control | Preventative or Detective Control? | Testing Results |

|---|---|---|

| FSU prepares the AFP and updates funding amounts with population and price adjustors (where applicable) and any other relevant information | Preventative |

|

| FSU Manager reviews AFP | Detective |

|

| TMD Director reviews AFP and approves Section 32 | Detective |

|

Based on the testing results, there is an opportunity for key stakeholders to more clearly and consistently document evidence that control activities were completed (e.g., when the FSU Manager reviews the AFP and TMD Director reviews the AFP and approves pursuant to Section 32 of the FAA).

Without requirements for documented evidence of completed control activities, the review and approval control activities may not be undertaken, resulting in errors or omissions in the AFP.

See Recommendation #6 in Section 3.3.3 below to address the lack of defined document retention practices.

3.3 Annual Amendments to Existing Fiscal Transfer Agreements

Background

The Treaty Management Directorates with support from the FSU are responsible for developing annual amendments to existing FTA at the end of the fiscal year to incorporate any funding that may be transferred from OGDs through Interdepartmental Letters of Agreement (ILAs) and supplementary estimates or any funding that results from other TB Submissions for the Department (e.g., incorporating any new funding that is allocated to CIRNAC following the annual federal budget). Adding this funding to each FTA it applies to supports the whole-of-government approach to working with SGIGs through a single funding agreement. This additional funding is normally considered 'non-core' or 'specified period' funding; it is often limited-time funding and not subject to price or volume adjustors. During this sub-process, the Treaty Management Directorates and the FSU undertake reviews to ensure that SGIGs are not being double-funded by CIRNAC and another government department.

The timeframe for the preparation and execution of the amendments is constrained and driven by central agency processes and OGD readiness. For example, the ILA, may be provided by OGDs in the summer. CIRNAC may prepare the TB Submission package that contains all the ILAs for that year in time for the Supplementary Estimates B process. However, depending on political priorities, the package may not be reviewed until the Supplementary Estimates C process. This results in the appropriations being granted royal assent in March, at the end of the fiscal year. All amendments therefore often must be signed by the Implementation Branch in a condensed period, sometimes within a few days or a few hours.

Additionally, the number of ILAs developed every year between CIRNAC and OGDs is dependent on the number of OGDs that are seeking to transfer funding to CIRNAC as well as CIRNAC and OGD internal policy decisions. There is no standard ILA template that is used. Some OGDs may develop a separate ILA every year for each of their programs that are transferring funding to CIRNAC, even if their programs span multiple years. Other OGDs may develop an ILA that transfers funding to CIRNAC over a multi-year period. Overall, the FSU is required to gather information from multiple sources (i.e., ILA and TB Submissions) every year to inform the development of the annual amendments.

For the annual amendment sub-process, the audit expected to find a defined and documented sub-process, supported by tools and information sources including the associated guidance, with appropriate preventative and detective controls in place to reduce the likelihood of errors and omissions.

Risk

There is a risk that technical or administrative errors and omissions (e.g., incorrect OGD funding amounts included in AFP or amendments, incorrect funding amounts being distributed to SGIG, etc.) would occur.

Finding

3.3.1 Sub-Process of Preparing and Approving Annual Amendments to Existing Fiscal Transfer Agreements

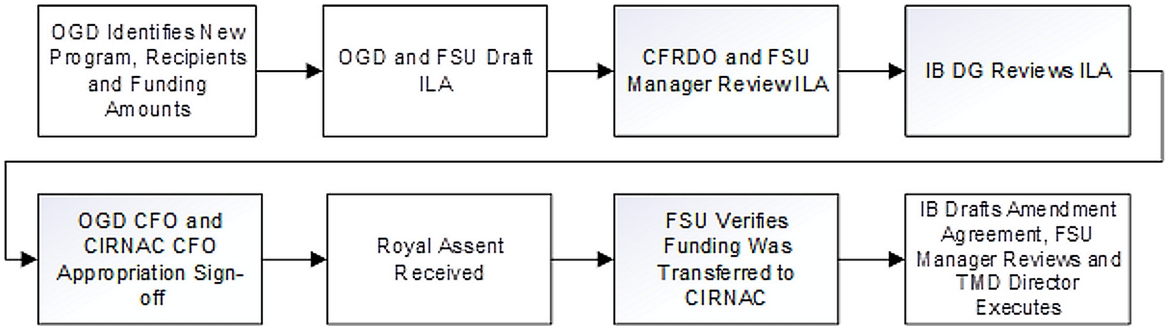

Key stakeholders follow a consistent sub-process every year to develop the annual amendments to FTAs to reflect any new funding received for that fiscal year. However, the sub-process, including key roles and responsibilities, has not been formally documented. To support an assessment of controls, the audit developed a process map to capture the steps and activities that are carried out by key stakeholders in the annual amendment sub-process. The development of a process map also included an identification of key controls that were established by the Treaty Management Directorates and the FSU to prevent and detect errors in the process. Figure 3 provides a summary of the sub-process.

Text alternative for igure 3 Overview of Transfer Process Leading to the Annual Amendment Sub-Process

Figure 3 provides an overview to capture the key steps and activities that are carried out by key stakeholders in the annual amendment sub-process.

The steps illustrated in the process diagram are as follows:

- OGD Identifies New Program, Recipients and Funding Amounts

- OGD and FSU Draft ILA

- CFRDO and FSU Manager Review ILA

- IB DG Reviews ILA

- OGD CFO and CIRNAC CFO Appropriation Sign-off

- Royal Assent Received

- FSU Verifies Funding Was Transferred to CIRNAC

- IB Drafts Amendment Agreement, FSU Manager Reviews and TMD Director Executes

The lack of a formally documented annual amendment sub-process is a result of the complexity of the broader self-government financial mandating process. Without a formally documented sub-process, operations may be disrupted or delayed if the sub-process is not communicated or well understood, errors or omissions may occur, and corporate knowledge may be lost with employee turnover.

Recommendation

3. The Assistant Deputy Minister of Implementation Sector should leverage the process maps and narratives developed by Internal Audit to define and keep updated documentation of the processes including the reviews and authorizations, steps, controls, and roles and responsibilities. This should be done for the following sub-processes:

- The renewal sub-process;

- The preparation and review of the AFP sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

3.3.2 Tools and Information Sources Used in the Annual Fiscal Arrangement and Plan Amendment Sub-Process and the Associated Guidance

The primary tools used in the annual fiscal plan amendment sub-process are Excel, GCIMS, and SAP. The Excel tools used in the process were designed by the FSU. The FSU Manager maintains a master Excel spreadsheet to track all incoming funds expected or received (i.e., appropriated), including through main and supplementary estimates, as well as payments to SGIGs. The FSU also maintains a separate Excel spreadsheet to keep track of all incoming OGD funding. As in the AFP sub-process, GCIMS is the system of record for the FSU and is the authoritative source for agreement-related documentation and SAP is the system used to issue payments once everything has been approved by CFRDO.

The primary information sources used in the annual amendment sub-process are the self-government FTA, the AFP, ILA, and TB Submissions.

The heavy reliance on Excel spreadsheets to document and manipulate the detailed financial information used to control the annual amendment sub-process is labour intensive and potentially prone to errors.

The tools and information sources in the annual amendment sub-process have been identified and are being leveraged consistently by key stakeholders. However, there is no guidance available to support the application of those tools and information sources. The lack of guidance to support the use of tools and information sources in the annual amendment sub-process is a result of a lack of a formally documented process for the self-government financial mandating process overall. Without documented guidance for the use of tools and information sources, errors or omissions may occur, and corporate knowledge of the process and tools may be lost when there is employee turnover.

Recommendations

4. The Assistant Deputy Minister of Implementation Sector should strengthen the use of control features within its Excel spreadsheets. This should be done for the following sub-processes:

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

5. The Assistant Deputy Minister of Implementation Sector should develop guidance materials on the use of tools and information sources. This should be done for the following sub-processes:

- The renewal sub-process

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

3.3.3 Preventative and Detective Controls in the Annual Fiscal Arrangement and Plan Amendment Sub-Process

The following table summarizes the key controls in the annual amendment to the Fiscal Arrangements and AFP sub-process that the audit identified as well as the results from testing the operating effectiveness of these controls, based on the selected sample of 10 agreements and the selected sample of OGD transfers and "non-core" funding. Overall, the audit found that the key controls in the annual amendment sub-process were implemented and operating effectively; however, one control could not be assessed due to lack of documentation. The audit did not identify any design gaps or weaknesses in the key controls.

| Key Control | Preventative or Detective Control? | Testing Results |

|---|---|---|

| CFRDO and FSU Manager reviews the ILA or TB Submission | Preventative |

|

| Implementation Branch DG reviews and signs the ILA, or the Implementation Sector ADM reviews and signs the TB Submission | Detective |

|

| CFO signs off on the ILA or TB Submission | Detective |

|

| FSU confirms that funding has been transferred to CIRNAC reference levels | Preventative |

|

Recommendation

6. The Assistant Deputy Minister of Implementation Sector should establish a formal standard for the documentation required to be retained to demonstrate that control activities have been carried out. This should be done for the following sub-processes:

- The annual updates of funding schedules for self-government activities sub-process; and

- The preparation and approval of annual amendments to existing fiscal transfer agreements sub-process.

4. Conclusion

The self-government financial mandating process, specifically the three in-scope sub-processes (i.e., the renewal of existing self-government fiscal transfer agreements; the annual update of funding schedules for self-government activities; and the annual amendments to existing fiscal transfer agreements), is highly complex. This complexity is driven by multiple factors, including the multi-stakeholder environment surrounding the self-government financial mandating process; the introduction of new policy (i.e., Canada's Collaborative Self-Government Fiscal Policy) and associated expenditure need methodologies; and the fact that each negotiation, Fiscal Transfer Agreement (FTA), and relationship with a given Self-Governing Indigenous Government (SGIG) is unique and must be managed accordingly. Lastly, the required flexibility and variability of these sub-processes (i.e., the process flow can be altered based on requests or recommendations from Central Agencies) contributes to the complexity by making it challenging to document processes in a consistent manner as well as corresponding process guidance.

To understand the three sub-processes and to identify and evaluate the controls in these sub-processes, the audit team developed process maps and supporting narratives for the three in-scope sub-processes which can be leveraged by the Implementation Branch for the purposes of process improvement.

Overall, the audit concluded that the design of most controls was strong. There were adequate oversight controls in place in the three in-scope sub-processes; however, the performance of some controls was not documented.

5. Management Action Plan

| Recommendations | Management Response / Actions | Responsible Manager (Title) | Planned Implementation Date |

|---|---|---|---|

| 1. The Assistant Deputy Minister of Implementation Sector should develop, to support the renewal sub-processes, standard processes and tools to collect and document information on each Self-Governing Indigenous Government, self-government agreement and fiscal transfer agreement and make it available for the analysis and calculation of funding obligations. | Implementation Sector to finalize the creation of a collection within GCDOCS that would compile all Fiscal Transfer Arrangements, Final Agreements and amendments, Annual Fiscal Plans (including the calculation and adjustors applicable by program element, population and reference for price adjustments) | Manager, Funding Services Unit | October 31, 2023 |

| 2. The Assistant Deputy Minister of Implementation Sector should design and implement controls to validate the sector's work when applying new expenditure methodologies and other changes to support a reconciliation with the prior funding amounts for each Self-Governing Indigenous Government. The process should include review and approval by appropriate internal participants (e.g., Funding Services Unit Manager, Treaty Management Directorate Directors, etc.). | Implementation Sector will improve its existing controls for applying new expenditure methodologies and other changes to fiscal transfer agreements. This will include designing, implementing and documenting specific controls to confirm new methodologies are appropriately applied by Implementation Sector officials. This will include review and approval by internal participants, including validation of all changes relative to prior funding amounts. |

Senior Manager, Fiscal Operations Directorate |

March 31, 2024 |

| To support accurate application of new fiscal methodologies and other changes to fiscal transfer agreements, the Implementation Sector will build and maintain a single database that documents the program and services jurisdictions recognized in all self-government arrangements with Self-Governing Indigenous Governments, as well as funding amounts (broken down by category) that have been included in fiscal transfer agreements with these partners. | Senior Manager, Fiscal Operations Directorate | June 30, 2024 | |

3. The Assistant Deputy Minister of Implementation Sector should leverage the process maps and narratives developed by Internal Audit to define and keep updated documentation of the processes including the reviews and authorizations, steps, controls, and roles and responsibilities. This should be done for the following sub-processes:

|

Implementation Sector to document and maintain an up to date process map and narrative description to accompany it based on those provided by internal audit. It will specifically include the review, authorizations, steps, controls and roles and responsibilities for each of the following sub-processes:

|

Senior Manager, Fiscal Operations Directorate | October 31, 2023 |

4. The Assistant Deputy Minister of Implementation Sector should strengthen the use of control features within its Excel spreadsheets. This should be done for the following sub-processes:

|

Implementation Sector to strengthen excel control features or look at alternative system options/tools for the following sub-processes:

|

Senior Manager, Fiscal Operations Directorate | October 31, 2023 |

5. The Assistant Deputy Minister of Implementation Sector should develop guidance materials on the use of tools and information sources. This should be done for the following sub-processes:

|

Implementation Sector will develop guidance materials on the use of existing and future tools (including the database referenced in the response for response #2) for the following sub-processes:

|

Senior Manager, Fiscal Operations Directorate | June 30, 2024 |

6. The Assistant Deputy Minister of Implementation Sector should establish a formal standard for the documentation required to be retained to demonstrate that control activities have been carried out. This should be done for the following sub-processes:

|

Implementation Sector to document its processes based on the process maps provided by internal audit that would include the review, approvals, control tracking, defined roles and responsibilities for the following sub-processes:

|

Senior Manager, Fiscal Operations Directorate | October 31, 2023 |

Annex A: Audit Criteria

To ensure an appropriate level of assurance to meet the audit objectives, the following audit criteria were developed to address the objectives.

Audit Criteria

1. The self-government financial mandating process and its tools and information sources are defined and documented.

1.1 The self-government financial mandating process is defined and documented.

1.2 The tools and information sources used in the self-government financial mandating process are identified and processes are in place to guide their application.

2. Controls are in place to prevent and detect potential errors in the self-government financial mandating process.

2.1 Preventative controls are in place to minimize errors in the self-government financial mandating process.

2.2 Detective controls are in place to identify errors during the self-government financial mandating process.